Fintech is reshaping finance, ushering in a new era of digital prosperity, and changing the way we interact with money.

Fintech encompasses leveraging and integrating the financial services technology provided by various organisations to offer better customer services. This marks a fundamental shift in the way banking and financial services were previously delivered. It introduces innovative services, embodying a digital transformation philosophy through the adoption of easy and interoperable solutions and services. Initially conceived as backend technology, fintech has evolved to become more customer-centric and now forms the front-end of customer operations. It aims to provide very low-cost transactions and near real-time intelligence in financial transactions.

Key business solutions from fintech

Fintech has brought disruptive changes to the banking and financial services industry, impacting various key areas.

- Digital payments and mobile banking: Payments made using mobile apps eliminate the need for explicit interactions with banking systems

- Voice payments: Speech-to-text interfaces are being used for making payments

- Virtual cards: Payments are being made using virtual credit and debit cards for e-commerce and online transactions, replacing physical cards

- Decentralised finance (DeFi): This is being used to eliminate/minimise service fee and charges

- Crowdfunding: Small investments are being solicited from a broad group of investors

- Lending and other bank-related transactions: Innovative lending solutions are on offer

Key technologies used by fintech companies

Fintech relies on various financial technologies.

- Blockchain: Creating distributed ledgers for enhanced transparency

- Robotic process automation: Automating processes to handle repetitive tasks

- Big Data: Collecting and processing structured, semi-structured and unstructured data in real time, providing valuable insights

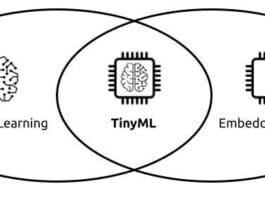

- Artificial intelligence/machine learning: Leveraging artificial intelligence and machine learning algorithms for better business results

- Cloud enablement with software-as-a-service and serverless technologies: Enabling rapid scalability by leveraging cloud services

- Quantum computing: Harnessing the high speed of quantum computers for cybersecurity, fraud detection, risk management, etc

- Open APIs and open source technologies: Connecting third-party APIs to financial systems

- Rapid application development: Leveraging low-code and no-code tools and techniques

Open source libraries for fintech

Fintech benefits from various open source projects, with some of the popular ones being:

- Qlib

- An open source project from Microsoft

- A platform for quantitative investment solutions that leverages AI/ML models and market dynamics paradigms

FinGPT

- A financial LLM (large language model) from AI4 Finance Foundation

Key benefits of financial technologies

Fintech offers a number of benefits, including:

- Exponential increase of transaction speed

- Real-time predictive models to act with very low latency and prevent/reduce failures

- Improved customer-centricity

- Higher user engagement with innovative solutions and services

Common disadvantages of fintech

Fintech also presents some disadvantages, such as:

- Privacy and security risks for users.

- Increased risks of data theft and identity frauds

- Cannibalisation and intense global competition leading to rapid disruptions

- Legal and regulatory challenges due to incoherent market activities

Fintech promotes financial inclusion by offering new opportunities to diverse communities that were previously excluded from traditional banking services. It leverages cutting-edge solutions to bring the unbanked into the banking industry. It fosters innovation in the financial sector, and extends financial benefits to the most underprivileged in the society, contributing to the greater global good.