According to Cryptoslate, the Solana network has frequently encountered outages and slowdowns this year, especially during periods of strong demand. In an effort to boost network dependability and performance, the Solana Foundation is now collaborating with Jump Crypto to create a new open source validator client. Jump Trading Group’s quantitative trading branch Jump Crypto develops blockchain infrastructure, according to Cryptoslate.

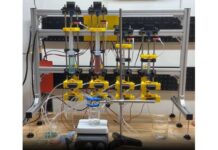

According to a press release from Jump Crypto on August 16, the validator will be developed using the C++ programming language. The announcement claims that it would also recommend significant modifications to Solana’s core open source software. Kevin Bowers, the chief science officer of Jump Trading, will be in charge of directing the creation of the new validator client, according to a news release.

Throughput, or the rate at which transactions are handled, efficiency, and resilience of the Solana network are intended to be considerably improved by the Firedancer project during the course of the coming 12 months, with further improvements in the following 12 months.

The Solana network experienced multiple slowdowns and outages in the months before to July, when it last encountered downtime, according to the incident report history for Solana. The network’s frequent slowdowns and failures crushed the hopes of institutional players looking for a more reliable and efficient network than Ethereum, the centre of most decentralised finance (DeFi) activity.

However, according to Anatoly Yakovenko, a Solana co-founder, the network has expanded considerably over the preceding two years. Solana’s market value climbed from less than $150 million in August 2020 to $14.96 billion at the time of writing, a roughly 10,000% rise.

“Through Jump’s decades of work in solving some of the most complex networking challenges across traditional financial markets, we have seen first-hand the impact that improving a network’s speed and efficiency can have on an entire financial system. Now, given the relatively slow speeds and unreliability of blockchain networks, an incredible opportunity exists to transform the functionality and efficacy of these networks,” Bowers states in a statement.