- Moov’s open source platform allows companies to deploy basic financial service solutions to receive funds, store value, and remit payments

- This round of funding enables Moov to continue to build the community, expand its engineering team to accelerate the product roadmap, and deepen partnerships and enterprise agreements

Open source embedded banking platform Moov Financial has announced that it has raised $5.5 million in seed funding. It was led by Bain Capital Ventures, with participation from Canapi Ventures, Commerce Ventures, Gradient Ventures, RRE Ventures, Uncorrelated Ventures, and 27 influential angel investors including Zach Bruhnke, Brandon DeWitt, Sima Gandhi, William Hockey, Brian Kelly, Mengxi Lu, Charley Ma, Calanthia Mei, and Emily White. Veridian Credit Union also participated in the round after signing a strategic partnership agreement

Moov’s open source platform allows companies to deploy basic financial service solutions to receive funds, store value, and remit payments. This round of funding enables Moov to continue to build the community, expand its engineering team to accelerate the product roadmap, and deepen partnerships and enterprise agreements.

Maria Palma, principal at RRE Ventures said, “As the financial services industry adapts to an open source-first movement, we must build and invest in solutions that benefit all participants with transparent, community-driven solutions. I’m delighted to partner with the Moov team as they redefine the basic building blocks of money movement.”

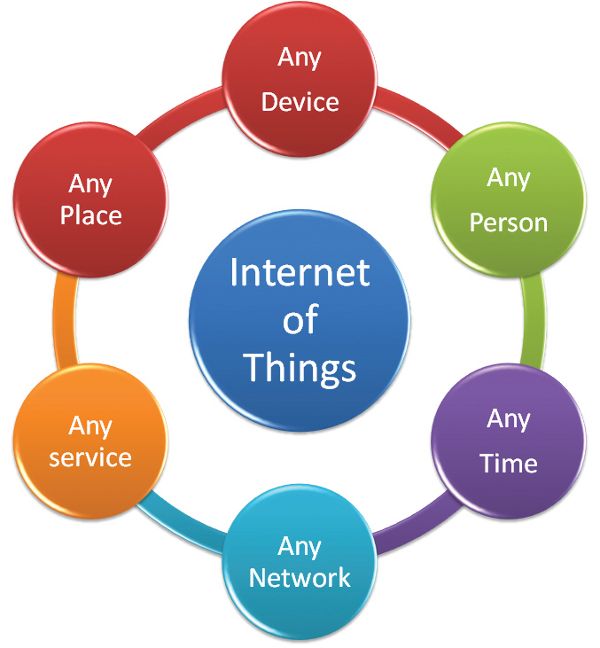

Banking-as-a-service platform

Moov’s banking-as-a-service platform takes a developer-first approach of being open source, portable to cloud providers or on-premises, modular for customization, and decoupled from any single bank program.

Steven Hufford, senior managing director and chief operating officer of Raymond James Investment Banking said, “Moov operates independently from traditional core banking systems, offering banks and credit unions the ability to collaborate and develop new fintech solutions. Rather than displacing branch systems, Moov-enabled institutions serve SaaS companies and fintechs with the latest technology protocols, benefiting all parties involved.”

In late 2018, Wade Arnold and Bob Smith began building the “Moovment”, creating a developer-first open source community focused on low-level financial infrastructure components. They had spent a decade building new technology platforms on legacy banking infrastructure, including building into 40 different core banking systems. These components help companies, digital banks, and fintechs to directly embed financial transaction capabilities within their product offerings, or leverage Moov to power additional infrastructure not provided by legacy offerings.

Wade Arnold, founder and CEO of Moov, said, “Seamless banking services have become a consumer expectation for technology companies in the same way the internet, cloud, and mobile have done in the past. Weee history being repeated in fintech where proprietary solutions were first to market and subsequently replaced by community-led efforts surrounding open source projects.”