Innovation leads to disruptions that often transform our world. Today, we look to startups as a crucial innovative force that can address real-life challenges that have not yet been attended to. However, product-driven technology startups in India are often hampered by numerous challenges in the ecosystem. What will it take for them to overcome these obstacles and create valuable IP? Paromik Chakraborty of the EFY Group speaks with Somshubhro (Som) Pal Choudhury, a partner at Bharat Innovation Fund, an early stage venture fund for deep tech and IP-led technology startups, to get that answer. The interview also gives readers an insight into how the fund plans to support the Indian startup ecosystem as it evolves.

Q What does the Indian startup ecosystem look like today?

A solid ecosystem has evolved over the recent past with global and local venture capital as well as angel/seed fund being available. There are over 200 accelerators/incubators operating within this ecosystem along with the 1000+ MNCs that have made India their R&D hub. The majority of the new generation of startup founders that we see today are more experienced. They have gained significant experience in these MNCs, have travelled and worked globally, and are more focused on creating globally competent products and platforms for today.

A plethora of challenges still remain, though. Indian businesses continue to be slow in adopting new technologies, and the availability of cheap labour in comparison to other developed regions delays any ROI from automation investments. There is also a lack of confidence in homegrown startups and a pervasive mindset of squeezing the best possible price out from them.

Now, most new age startups are following the Israeli model of establishing a global connect and customer base for scale-up, after product development and post piloting. They look to achieving the product-market fit in India even while taking into consideration the global customers’ requirements.

Q What is the main motive of the Bharat Innovation Fund (BIF)?

The Bharat Innovation Fund is a US$ 100 million early stage venture fund with a mission to invest in deep tech, IP and innovation-led startups in India, beyond the current wave of consumer focused e-commerce, hyper-delivery and marketplace models.

The roots and affiliation of the Bharat Innovation Fund go back to the Centre of Innovation Incubation and Entrepreneurship (CIIE), IIM Ahmedabad, that led several initiatives aimed at boosting entrepreneurship in India by backing purpose-driven entrepreneurs to solve some of the toughest problems for more than a decade.

We believe we have now entered the third wave of the startup evolution phase in India – focused on more B2B, IP and innovation-led startups. This is a different trajectory from the previous two waves which were IT/BPO/services based (in the 1990s) and the Indian consumer story with B2C e-commerce/marketplace models (in the last decade). While the consumer segment seems hyper-invested for now, with winners getting funded even though opportunities remain in niche areas, the startup ecosystem is becoming more about the enterprise, and is B2B, deep tech and IP focused.

Q What kind of businesses and which industrial segments will BIF focus on?

The Bharat Innovation Fund supports deep-tech innovations in various industrial segments including healthcare, agriculture, energy, fintech, digital and other emerging sectors. The Fund invests at the pre-Series-A and Series-A stages, and is backed by marquee Indian and global investors.

Deep tech for us involves the focus on core technology as a fort or moat for the business. We look for not just any technology-enabled solutions, but innovative ones that have the potential to create a defendable IP and hence prove difficult for competitors to replicate.

Q What criteria does BIF look for in the startups that it selects for funding?

At the Bharat Innovation Fund, we look for all the usual criteria that make a startup successful – a large and emerging market, a great team of co-founders, an innovative solution and traction in the market. We also look at the transformations that are happening in the market and try to crystal gaze about what to expect in the next few years, drawing analogies and comparisons with similar models and ecosystems. We search for differentiated technology and innovative solutions that will be the fort and moat to compete not just in India, but globally.

Q Tell us about the application procedure that startups follow to acquire aid from BIF.

It’s no different than approaching other venture capital funds. We encourage startup founders to reach out to us directly or through references. They could look for us on LinkedIn and Twitter, and reach out directly to the BIF team members, on their personal LinkedIn and Twitter accounts. We could also cross paths in the startup award juries, conferences and other startup events that we usually participate in.

Following the initial introduction, the founders should send a presentation of their company to us, articulating the problem they are trying to solve, the solution, the market size, the background of the founding team, the IP and tech innovation of the solution, its competitive analysis, traction in the market, and so on. As we are swamped with several startups approaching us, our reverts might not be quick. So they shouldn’t be shy to ping again if they don’t hear back from us within a few weeks!

The stakes are pretty high because while we may be interacting with close to 500-1000 startups in a given year, we will fund only 20-25 startups.

Q Apart from the fund, will there be any other form of support from your foundation?

Yes, we do go beyond funding. In addition to the capital, we also bring together global networks, distribution channels, research infrastructure, strategic insights, customer and partner connects, and the deep sectoral understanding of our investors and team. The BIF team brings together diverse experiences — from incubation and venture investing to building massively-scalable tech products, and decades of operational experience leading businesses in the corporate and startup spaces.

Q Which are the major organisations that have become members/investors in this initiative? Are there others in talks for coming on board?

The investors in the fund are corporates, banks, insurers, and funds of funds – including SIDBI through its Fund of Funds for Startups (FFS) programme, ICICI Lombard, Philips, Bajaj Electricals Ltd and RBL Bank, among others.

Ray Stata, founder and chairman of Analog Devices, who has been an icon of innovation for the last several decades, has also joined the Fund as an advisor and investor.

Q What milestones has this venture reached so far and what are your immediate plans?

We have publicly announced investments in three startups so far. The Bharat Innovation Fund did its first formal close in July 2018 and immediately started investing. We have publicly announced three investments – in Entropik, Detect Technologies and CreditVidya.

We are in the final stages of doing the due diligence for a few more startups which will be announced shortly. We feel encouraged by the sheer quality of deals and the type of IP-led innovation we have come across in healthcare, fintech, industrial and in overall digital transformation.

Q Tell us about the startups funded till now.

Of the three start-ups we’ve invested in so far, let’s look at Entropik Technologies. It is an emotion AI company that provides insights on a consumer’s subconscious responses to external stimuli. The company’s proprietary solution, Affect Lab, is an online emotional intelligence platform that combines EEG brainwave mapping, facial coding and eye tracking technologies that can be used by brands and content creators for end-to-end consumer research, with long-term potential in creating an emotion AI database.

Detect Technologies is a startup that originated in the IIT Madras incubator. It uses a proprietary magnetostrictor material sensor and advanced image processing algorithms to determine defects in high temperature oil pipelines. It also provides software and algorithms built on top of third party drones, for the inspection of hard-to-reach assets in difficult climatic conditions and in inaccessible terrain.

CreditVidya is a startup that is strengthening the lending market in India by automating the underwriting process in digital lending through a machine learning-enabled credit risk assessment platform. It uses alternative data in addition to bureau information. The technology is implemented through software integration into the lenders’ workflow process, assisting in loan disbursal.

Q How deeply does BIF collaborate with those in Indian academia?

BIF is built on the decade-long startup engagement experience of CIIE, IIM Ahmedabad, which has seeded over 200 startups across its various programmes such as iAccelerator, Power of Ideas, Powerstart, India Innovation Growth Program, and Startup Oasis, to name a few.

We work closely with many academic startup incubators at several IITs, at the IISc and other institutions. We also are in touch with top academicians from universities and research institutions. We collaborate with them to build our investment thesis, and routinely reach out to technical experts to understand the new technologies and IPs of startups that seek us for their funding needs.

QWhich verticals, according to you, provide the best business opportunities for electronics and tech startups today?

For startups, a purely hardware play might prove difficult in a super competitive landscape. But a hardware-software combination that captures data from the physical world and then uses AI/ML to build analytics solutions is where the opportunity for Indian electronics and technology startups lies.

While there are opportunities to innovate in the electronics sector alone (with sensors, bio-printing, AI/ML hardware accelerators, etc), the pool of such innovative startups from India is relatively small and they need to compete on these fundamental technologies globally. But the opportunity we see is in the hardware-software combined play that leverages the software strengths of the Indian ecosystem.

Q What do you think are the biggest challenges product-based technology startups face today?

The biggest challenges faced by product-based hardware driven startups in India are the lack of facilities for prototyping and design for manufacturability, as well as the relative dearth of an overall electronics manufacturing ecosystem. Iterations take time and access to quality vendors in India is still a challenge.

The government initiatives of value addition, although improving the ecosystem, still have a long way to go. Many have ventured out to China to access this ecosystem but relatively smaller quantities and not being physically present has hindered their efforts. The challenge is also lack of funding for these startups in the subsequent rounds and access to early homegrown customers who are willing to adopt the technology or solution.

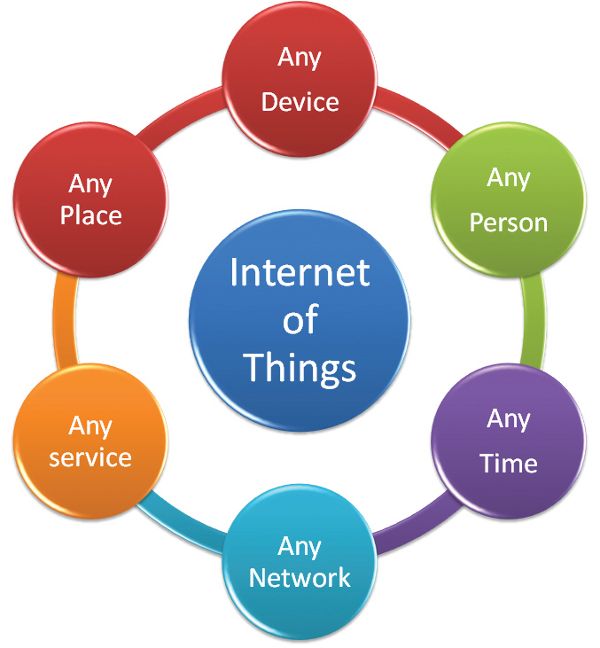

Q What are the solutions to these challenges?

The India Electronics and Semiconductor Association (IESA) and IoTForum, a think tank working on building the IoT ecosystem, are focused on potential solutions for these challenges. For example, IESA has now started a fabless initiative with the government of Karnataka to help incubate the fabless semiconductor startups by giving them access to EDA tools and funding test chips. There are also several hardware-only incubators and accelerators like Forge, NASSCOM IoT and Revvx that are focused on bridging this gap. Large MNCs, including Intel and Airbus, now have their own incubators to help these startups.

Q Has the Indian government played a significant role in supporting/promoting BIF or your initiatives?

The startup initiatives by the Indian government are promising. We are a beneficiary of the Startup India Fund of Funds by SIDBI. A similar initiative by the Electronics Development Fund (EDF) is worth mentioning. Startup India initiatives by the government are oriented in the right direction. A number of incubators and accelerators, including the government, academia and MNCs, are already helping the startups and handholding them through the initial stages. Similarly, the different state governments are supporting the startups in their own way. The initiative of giving grants to qualified startups by the government of Karnataka as part of its ‘Idea2Poc’ and ‘Elevate’ initiatives is helping the overall startup ecosystem in the state.

Initiatives by the Department of BioTechnology with grant programmes like the BIRAC (Biotechnology Industry Research Assistance Council) ‘BIG Grant’ scheme have done extremely well for the early stage healthcare and biotechnology startups in India. Such initiatives in other sectors would be a welcome move. Encouraging the Indian financial institutions and the fund managers of vast family-run enterprises to invest in venture funds and private equity funds would actually increase the pool of risk capital significantly, for later stage funding. This is still extremely mini-scale in India, especially for the type of startups we are focusing on.

Q What more can be done in the field of funding?

One big challenge in the Indian startup ecosystem, especially in the B2B space, is the lack of early adopters among Indian customers. An initiative that earmarks a small portion of the technology and solutions budget assigned to the different states and central government, for qualified startups, could be a welcome initiative.

Efforts are underway for the government to offer preferential access to Indian companies for critical infrastructure, defence and security needs. Similarly, creating an incentive structure for the bigger companies to acquire a small portion of their purchases from Indian startups would create a vibrant customer base. We live today in a volatile, uncertain, complex, and ambiguous (VUCA) world, and existing businesses and business models are being transformed in ways unheard of. To remain competitive, the large technology and solutions buyers could benefit immensely by engaging with the startup ecosystem. To a limited degree, we are starting to see this happen in India, but we need to do a lot more.

Q What would you advise the entrepreneurs in India who plan to start their own technology business?

Entrepreneurship is tough and not for the faint-hearted. Forming a balanced team with both business and technology acumen, understanding and scoping out the problem statement, devising a technology solution that isn’t right just for today but also defensible in the long run, getting traction with early lead customers, are some of the general yet crucial recommendations. I would recommend every aspiring entrepreneur to read the ‘The Startup Owner’s Manual’ that highlights the lean startup models and also binge watch the TV show ‘Sharktank’.

Every startup is unique. Startups transform industries and business models; hence, by nature they should be disruptive and should not follow a unique proven formula other than the basics. Based on what I have seen in the startup ecosystem so far, I would tell entrepreneurs to conduct better market research and do a competitive landscape analysis. Then look for opportunities to partner, rather than build the entire solution on your own.